|

|

Applies to versions: 3.2, 3.3, 4.0

Overtime Policies

Overtime Policies define how overtime is calculated for workweeks. These policies stand alone and do not, by themselves, determine how overtime is calculated for any one employee. Instead, you must link Overtime Policies to Workweek Groups.

NOTE: If you have upgraded your TimeIPS system, you may notice that you have Overtime Policies named after individual employees. These employees had custom legacy rules that were upgraded.

The Overtime Policy rules are dictated by State and Federal laws, which sometimes change. To facilitate compliance over time, the Workweek Group configuration allows setting the dates when the Overtime Policy is used. Correct Overtime Policy settings and application to employees is very important. Please carefully review US Federal Labor Law, 29 CFR Subpart B 778, as well as any state-specific rules that may cover your business/organization and employees. For any questions, please seek advice from an attorney specializing in labor law in your state and industry.

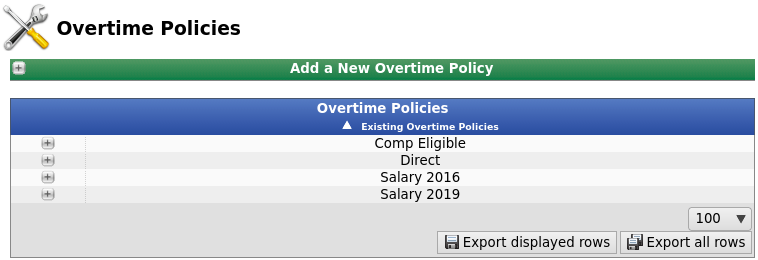

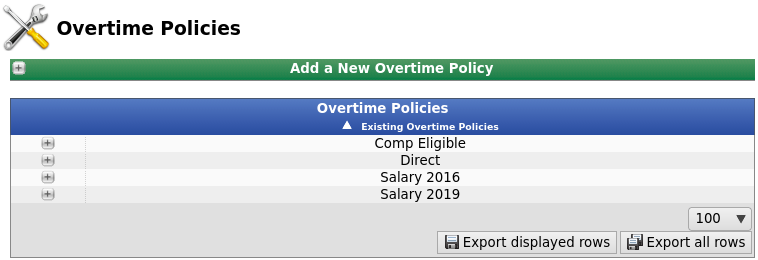

Using the left pane Main Menu » Administration, click on: Payroll » Overtime Policies

Create a New Overtime Policy

- Click on the + (plus) sign to the left of the Add a New Overtime Policy bar.

- Type the new overtime policy Name. The name normally reflects the type of employee, location of employee and/or time frame covered by the Overtime Policy. For example, "Direct" for direct employees, "Union" for unionized employees or "California 2017" for employees working in California with rules in effect for 2017.

- Click on the Add New Overtime Policy button.

- The new overtime policy will be created and added to the list of Existing Overtime Policies below.

Edit Existing Overtime Policies

- Select the Overtime Policy by clicking the + (plus) sign next to the name.

- Adjust the information as necessary under the General, Advanced, and Pay Overrides tabs.

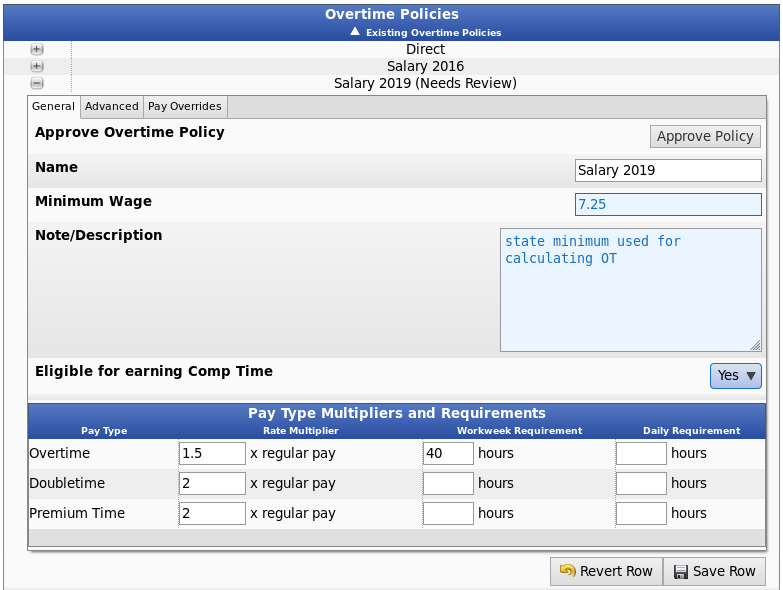

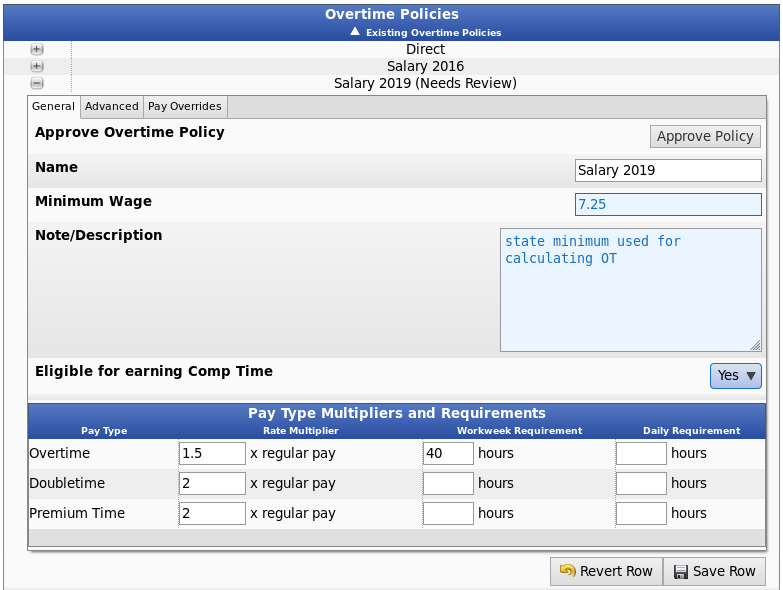

General

- Approve Overtime Policy will appear when you first create the policy. You can approve these overtime policy settings by making changes and saving, or if the current settings are correct, using the Approve Policy button.

NOTE: Payroll exports will give a warning if these settings are used in an export and have not been approved.

- The Name is used to identify this overtime policy on the workweek groups page. You can change it here. Use a different name for each group of employees with different overtime requirements. For example, Direct, Contract, Hourly, Salary, Office, or Warehouse.

- Enter the Minimum Wage amount that applies to this overtime policy.

NOTE: When minimum wage changes due to state or federal law, a new Overtime Policy should be created with the new rate.

Some piecework and salary pay arrangements can result in effective base rates that drop as more hours are worked. If a Minimum Wage is set, the payroll engine will ensure employees are paid at least this amount for all hours worked.

Examples:

- An hourly employee may work a job with a pay rate less than minimum wage. In this case, they'll need to get minimum wage.

- An hourly employee may work at various hourly rates, usually due to job differentials. For example, an hourly employee may work 35 hours at $5/hour, then 10 more hours at $10/hour. The average wage may end up less than minimum. In this example, the average pay is $6.11. If minimum wage is $10, $3.89 needs to be added to each hour to bring them up to minimum wage while still maintaining the pay difference for the jobs in the week.

- If salary non-exempt employees are paid for "All Work" in the week, and hours increase, it's entirely possible to slip below minimum wage. The payroll engine should never allow the employee's total pay to fall below minimum wage.

- A Note and/or a Description of this overtime policy can be added. It is optional and only used for your reference.

- If employees who use an overtime policy are eligible to earn FLSA 29 US 207 (o)(3)(A) Compensatory time, set the Eligible for earning Comp Time option to "Yes".

NOTE: This option will only appear if the IPSCOMP module is installed.

- Pay Type Multipliers and Requirements

NOTE: The above settings are the default settings for all new overtime policies. Based on your company's needs, you can modify these settings using the following options.

- Modify the Rate Multiplier, Workweek Requirement, and Daily Requirement for Overtime, Doubletime, and Premium Time as needed.

- The Workweek Requirement is the number of standard hours in a week an employee must work before their time is promoted to that pay type. For example a Workweek Requirement of 40 for Overtime means that an employee will go into Overtime as soon as they have 40 qualifying hours within a workweek.

- Daily Requirements define the number of hours in a day before an employee's time is promoted to that type.

TIP: If this Overtime Policy should not pay Doubletime or Premium Time, clear the Workweek and Daily Requirements for Doubletime or Premium Time. If this Overtime Policy should not pay overtime, also clear the Workweek and Daily Requirements for Overtime..

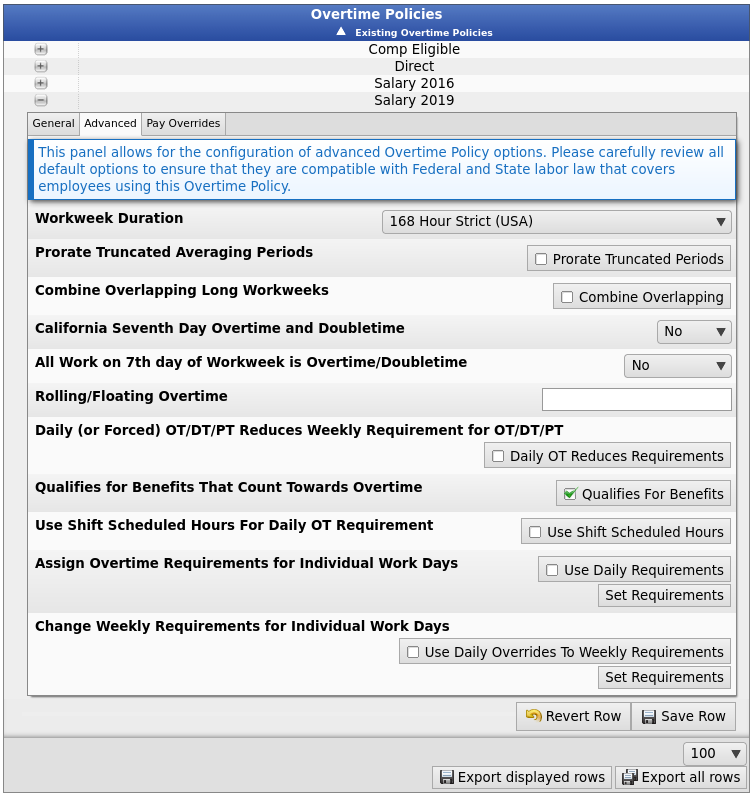

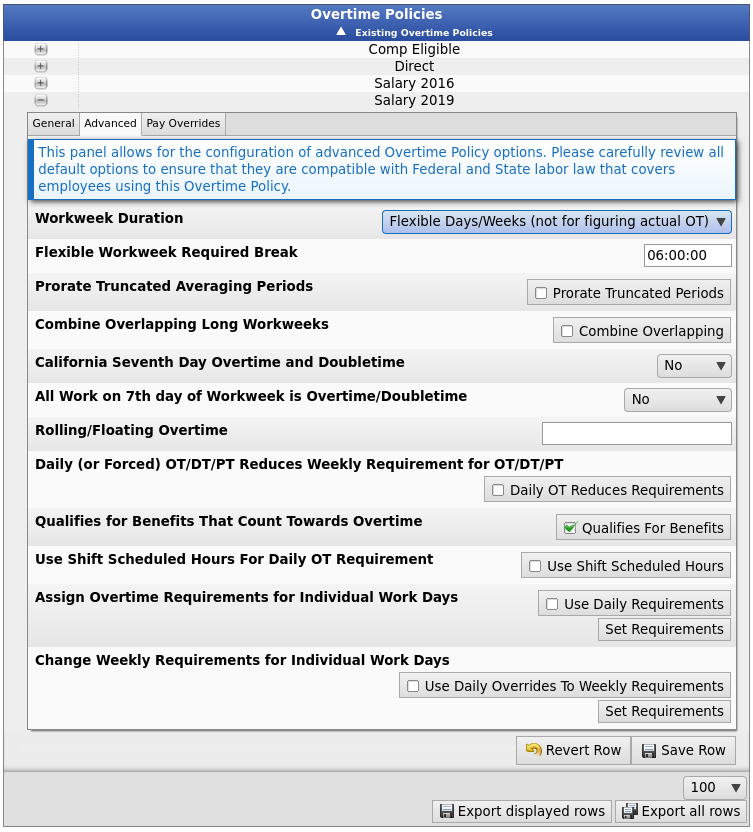

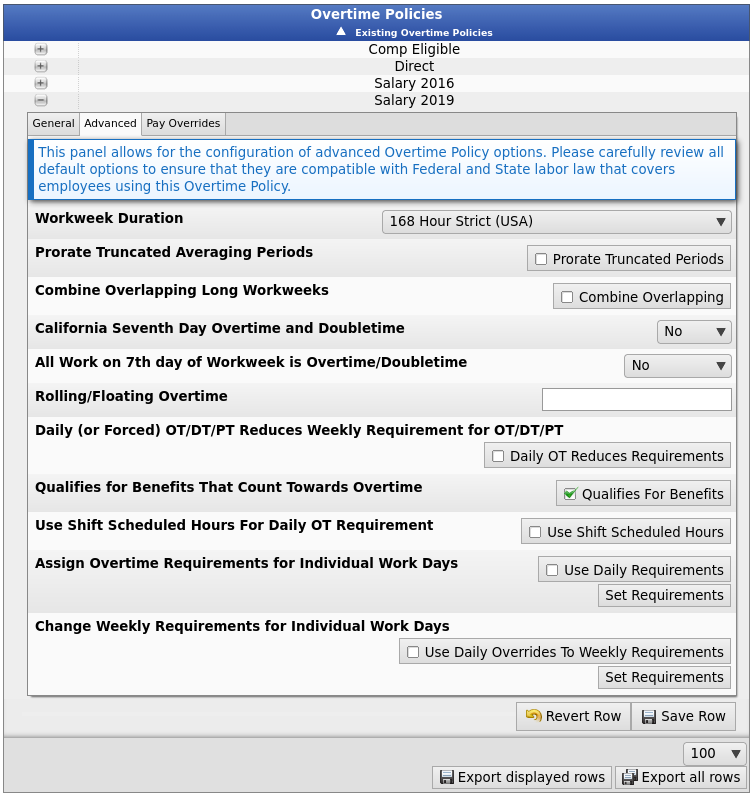

Advanced [for 168 Hour Workweek]

- Choose your option for Workweek Duration. US Federal Labor Law (29 CFR 778.105) defines a Workweek to be a recurring period of 168 Hours (7 consecutive 24 hour periods).

- The "168 Hour Strict (USA)" option implements this exactly, including on DST (daylight savings time) transition weeks when the calendar week is either 167 or 169 hours long. Although this complies with the legal definition, if workweeks are set to follow DST, it will cause overlapping workweeks with offset days twice a year. More Information on the implications of DST transitions on workweeks and overtime calculations for Spring and Fall.

- The second option, for "167-169 Hours, DST Friendly (Canada)" allows workweeks to vary in length to accommodate DST changes (if DST is in use/effect). This option is specifically allowed in Canada Labour Code, Part III, 166 as of Jan. 1, 2007. In the USA, some organizations also choose this option if employees do not work across workweek boundaries, as this means there will be no difference in the calculation of overtime and it prevents overlapping workweeks twice a year. More Information

- The third option, for "Flexible Days/Weeks (not for figuring actual OT)" is intended for reporting purposes only. It is NOT intended to be used in figuring actual overtime pay for employees. In this mode, the workweek (and the work days within them) are figured dynamically by looking at segments of actual work performed by the employee. This allows the grouping of "days" and "weeks" in a way that may be more intuitive for employees that work varied shifts. If this option is used, an external system must be used to figure the overtime legally due to employees.

- Most company's overtime is based on hours worked in one week and/or in one day. If your company calculates overtime based on time worked in two-to-four weeks, set the following options as applicable:

- Choose whether you want to Prorate Truncated Averaging Periods. If this option is checked, in the event that workweeks of more than one calendar week overlap due to changes in Workweek Group settings the first overlapping workweek will have its overtime (and doubletime) calculated based on prorated overtime rules. If unchecked, overtime in overlapping workweeks of more than one calendar week in length will be calculated according to U.S. Department of Labor (US), Field Operations Handbook 32j13(c) as of Jun 30, 2000.

- Choose whether to Combine Overlapping Long Workweeks. If workweeks of more than one calendar week in length overlap but are the same length, some companies treat the overlapping workweeks as one workweek for overtime and doubletime calculation purposes. To enable this behavior, check the box. Most organizations will prefer to leave it unchecked to disable this behavior.

- If applicable, choose your option for California Seventh Day Overtime and Doubletime.

- Treat work done in the "first eight hours worked on the seventh day of work in any one workweek" as overtime and "any work in excess of eight hours on any seventh day of a workweek as doubletime" in accordance with California Labor Code (Section 510 (a)) by selecting Yes (1).

- Choose Yes (2) if you are a California company that chooses to follow the interpretation of Section 510(a) as follows: "the [Labor Commissioner] has indicated in its enforcement policy that it intends to follow the historical rule and require the premium only if an employee works all seven days in the workweek." As explained by the author earlier in the footnote, "[t]he seventh-day premium has historically applied only if an employee worked on each of the days in the workweek, not simply on the seventh day. If A.B. 60 were construed otherwise, it would result in the illogical conclusion that overtime premiums would be owed for a single day of work if that work occurred on the last day of the workweek."

- Some employers choose to pay doubletime for any work on the seventh CONSECUTIVE day of work in a work week; select Yes (3) to pay this way.

- If Section 510(a) of California's Labor Code does not apply to employees following this Overtime Policy, select No.

- Choose whether All Work on the 7th day of a Workweek is Overtime/Doubletime. Some companies treat all time worked on the 7th day of a workweek as overtime or doubletime regardless, with no change after eight hours. If this is the desired behavior for employees following this Overtime Policy choose "Overtime" or "Doubletime" otherwise, choose "No."

- If applicable, enter Rolling/Floating Overtime hours. Some situations require overtime for employees if their work hours exceed a set amount in any given period. Enter this as Hours Worked / Rolling Hours. Examples: 8/24 for 8 hours worked in any rolling 24 hour period, 40/168 for 40 hours in any rolling one-week period, or 8/8 for any clock-in for 8 hours consecutively. Other situations require overtime for employees if their work hours exceed a set amount in any floating window after a minimum gap. Enter the as Hours Worked / Floating Window Hours / Minimum hours gap. For example 8/24/4 for 8 hours worked per 24 hours, where the 24 hours starts after any 4 hour gap. The floating window can extend beyond the set hours until a minimum gap occurs. Set blank or 0 to disable.

- Choose whether Daily (or Forced) OT/DT/PT Reduces Weekly Requirement for OT/DT/PT: If checked, when employees receive OT/DT/PT due to daily requirements or forced overrides, the weekly hours required to reach OT/DT/PT should be reduced as well.

- For example, an employee works 40 hours in a week with 8 hours promoted to OT due to exceeding daily requirements. With this option unchecked the employee would not earn weekly overtime until 48 hours total (when the weekly ST hours reach 40). With this option checked, the employee would begin earning weekly overtime at 40 hours total (when weekly ST hours reach 32).

- This option should generally be unchecked for federal labor law compliance.

- Choose whether an employee following this policy Qualifies for Benefits That Count Towards Overtime. Check the "Qualifies For Benefits" box if the employees following this policy should qualify for benefit types designated to count towards overtime/doubletime calculation. It is recommended this be checked.

- Choose whether to Use Shift Scheduled Hours For Daily OT Requirement. Employees may be members of a shift that specifies an expected number of scheduled hours per shift. Enable this option to use the shift scheduled hours in place of the overtime policy's daily OT requirement. If set, the shift scheduled hours will trump even the daily overrides to the daily OT requirements.

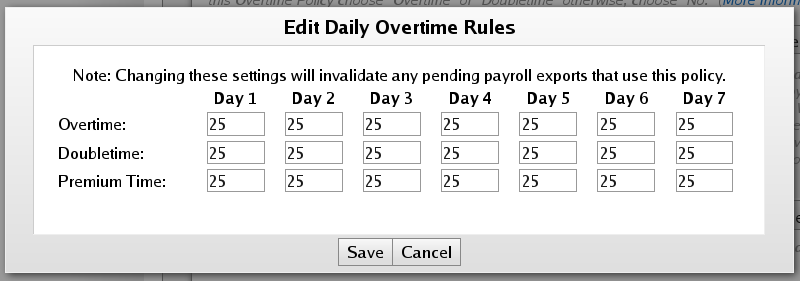

- Choose whether to Assign Overtime Requirements for Individual Work Days. By default, TimeIPS uses the same overtime rules for all days in each work week. Use this option to assign different rules for each work day. These work days are defined according to the start of the work week, either as 24-hour days if the "168 Hour Workweeks" option is enabled or starting at the same clock time each day otherwise. This option only allows specifying rules for seven days; if used for an averaging period of two weeks or longer, the rules will be repeated each week.

NOTE: When this option is enabled, the single "Daily Requirements" option on the "General" tab is ignored.

- Click the Save button to implement the change.

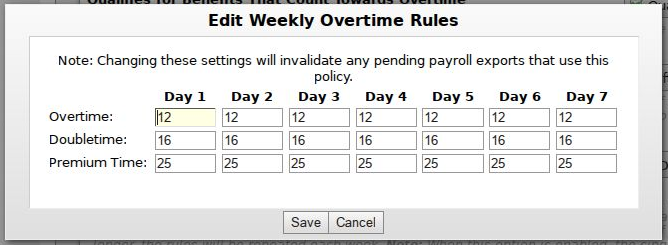

- Choose whether to Change Weekly Requirements for Individual Work Days. When evaluating worked time on a particular day of the week, an alternative weekly requirement for OT/DT/PT can be used instead of a fixed weekly requirement. For example, if company policy stated that all time on the 6th day of the week (that normally would be OT) should be DT instead, then this policy should be configured such that the weekly requirement for DT is the same for OT on the 6th day.

NOTE: When this option is enabled, the single "Weekly Requirements" option on the "General" tab is ignored.

Example 1: Employees should earn doubletime on the 7th day of the week, as long as they've worked at least 40 hours: Set the weekly doubletime level to 169 for days 1-6 and 40 on day 7.

Example 2: Employees should earn overtime on the weekend, as long as they've worked at least 32 hours in the week. Set the weekly overtime level to 40 for days 1-5 and 32 on days 6-7.

Example 3: Employees earn overtime after 32 hours during the week, but after 40 hours on weekends. Set the weekly overtime level to 32 for days 1-5 and 40 on days 6-7. Important: When the required hours increases later in the week, use care when combining this with the Daily (or Forced) OT/DT/PT Reduces Weekly Requirement for OT/DT/PT rule above. When employees reach OT for any reason, the weekly requirement will be reduced and it can result in unexpected overtime on days where the requirement level is increased.

- Click on the Set Requirements button to Edit the Weekly Overtime Rules.

NOTE: Changing these settings will invalidate any pending payroll exports that use this policy.

- Once you have completed your adjustments on the Advanced tab, click on the Save Row button to save your changes, or click on the Revert Row button to exit without saving your changes.

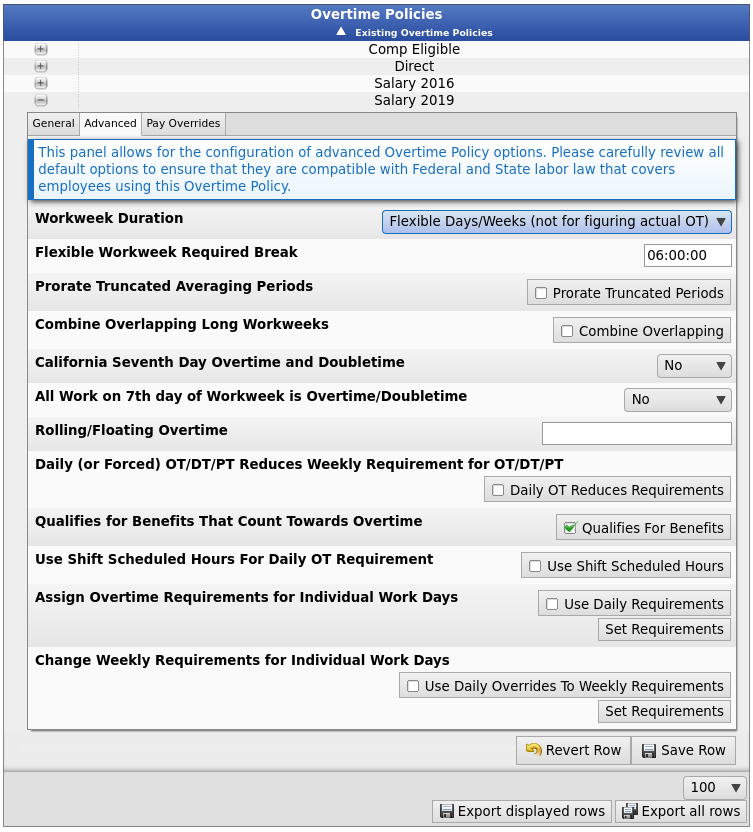

Advanced [for Flexible Days/Weeks]

Flexible workweeks define days as periods of work separated by a break of a minimum length. If "Flexible Days/Weeks (not for figuring actual OT)" is chosen, the Flexible Workweek Required Break option will appear and need to be set.

- Enter the minimum break that will be used to define a day, for example 6 hours (6:00:00). When employees work, then have a break of at least this length, it will be considered a new day. This means that it is likely there will be fewer (or more) than 7 days, depending on the duration of the break and the hours worked. Daily OT rules will apply as expected for the first 7 of these "days." If additional days are created by the rule, the 7th day OT rule will apply to all subsequent days.

In the event that the end of the normal 168 Hour week falls in a break of at least the minimum duration, then the week will end normally. If there is not a sufficient break, the week will end at the last clock-out that is followed by a sufficient break.

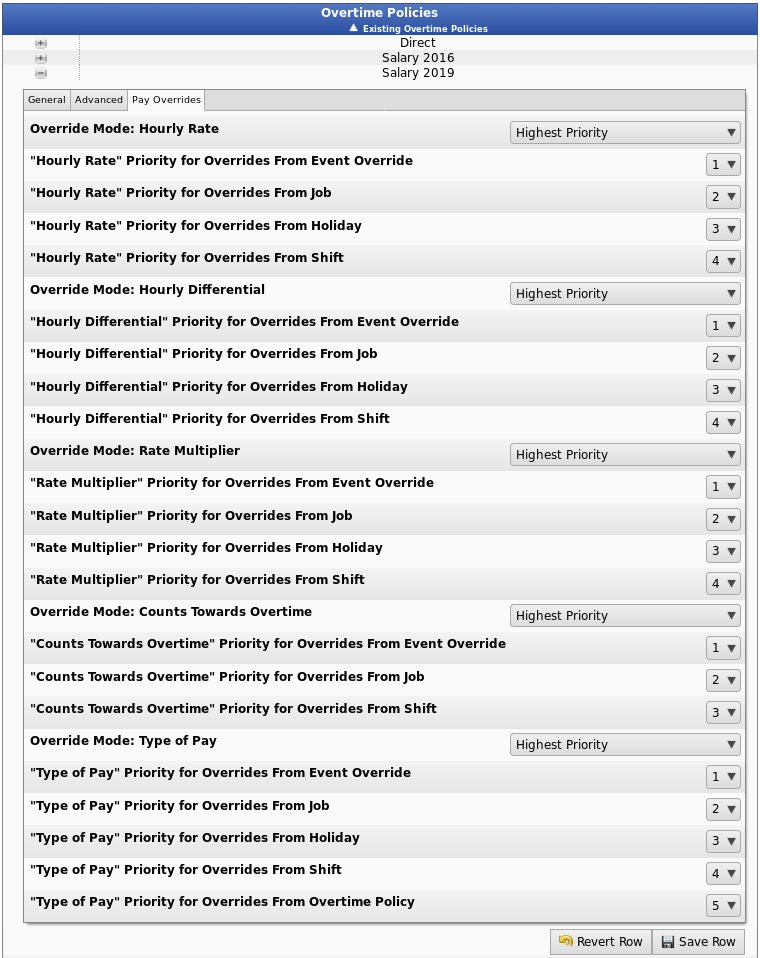

Pay Overrides

Employee pay calculations can be configured to be overridden when employees work on specific jobs, during certain shifts, during holiday observances or even on an individual event basis. The options in this panel define how these overrides are handled when an employee could potentially qualify for multiple overrides.

For each mode, choose how overrides are calculated when multiple overrides exist.

- Highest Priority will use the override source with the highest defined priority.

- If any of the override modes are set to "Highest Priority" then you must define the priority of potential override sources.

For Example: You might want overrides from a job to always take precedence over other override sources so you would set Job Priority to 1.

- Most Common will attempt to choose the override value that is the most common among all overrides. In the case of a tie among multiple options, the system can either choose the best option for the employee (Maximum) or the worst option for the employee (Minimum).

- Minimum will use the worst overrides for the employee.

- Maximum will use the best overrides for the employee.

- Average will attempt to calculate the average value of overrides.

- Sum will attempt to add the value of all overrides.

- Once you have completed your adjustments, click on the Save Row button to save your changes, or click on the Revert Row button to exit without saving your changes.

Net Pay Calculation Source

As of TimeIPS v1.5, TimeIPS Overtime/Doubletime Net Pay Calculations are based on the following documentation taken from: http://www.dol.gov/dol/allcfr/ESA/Title_29/Part_548/29CFR548.2.htm

(e) The basic rate so established is authorized by Sec. 548.3 or is authorized by the Administrator under Sec. 548.4 as being substantially equivalent to the average hourly earnings of the employee, exclusive of overtime premiums, in the particular work over a representative period of time;

(f) Overtime hours are compensated at a rate of not less than one and one-half times such established basic rate;

(g) The hours for which the employee is paid not less than one and one-half times such established basic rate qualify as overtime hours under section 7(e) (5), (6), or (7) of the Act;

(h) The number of hours for which the employee is paid not less than one and one-half times such established basic rate equals or exceeds the number of hours worked by him in any workweek in excess of the maximum workweek applicable to such employees under subsection 7(a) of the Act;

(i) The employee's average hourly earnings for the workweek exclusive of payments described in paragraphs (1) through (7) of section 7(e) of the Act are not less than the minimum hourly rate required by this Act or other applicable law;

(j) Extra overtime compensation is properly computed and paid on other forms of additional pay which have not been considered in arriving at the basic rate but which are required to be included in computing the regular rate.

[20 FR 5679, Aug. 6, 1955, as amended at 26 FR 7731, Aug. 18, 1961]

|

Information

Information Sales

Sales Support

Support