|

|

Applies to versions: 1.8, 1.9, 1.10, 1.11, 2.0, 2.1, 2.2, 2.3, 2.4, 2.5, 3.0, 3.1, 3.2, 3.3

Understanding Workweeks and Payroll Invalidation

Normally, payroll is prepared for a time frame that exactly matches one or more workweeks. However, it is possible to prepare a payroll run for any period of time including partial weeks. If the payroll run dates do not match with the workweeks of the employees included in the run, unexpected invalidations (or inability to edit for locked payroll) can occur up to one workweek following the report.

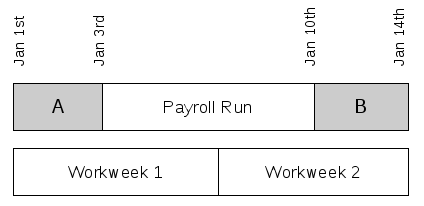

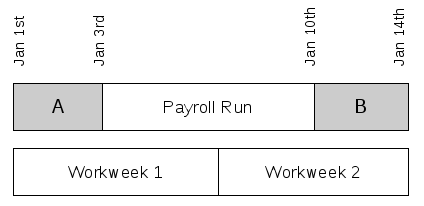

For example, in the diagram below, the "Payroll Run" is from Jan 3rd to Jan 10th. This time overlaps two workweeks for an employee as shown. The range of time where edits and adjustments can invalidate the payroll is not just the payroll run itself, but also time "A" (before) and "B" (after).

An edit during the range "A" may invalidate the payroll run for a number of reasons. Some examples are:

- Adding, editing or removing worked time:

Any change in the amount of time worked during "A" could change the point at which overtime will be reached in the week, thereby changing the amount of standard/overtime/doubletime pay during the payroll run and invalidating it.

- Changing an employee's pay rate:

If an employee gets a raise during the period "A" it may effect the total pay for the week and the FLSA base rate for part of the payroll run, invalidating it.

- Changing the pay or type of pay for any time:

If the amount of pay or the type of pay is modified (by direct edit, job differential, shift differential or holiday differential) then employee's FLSA base rate will change. This may effect the pay during the payroll run, invalidating it.

- Changing the workweek itself and/or overtime policies:

If any change is made to workweeks or overtime policies during "A" it will be very likely to change the calculation of overtime in workweek 1 and workweek 2, invalidating the payroll run.

An edit during the range "B" may also invalidate the payroll run. Under FLSA law, overtime pay must be a minimum of 1.5 times an employee's "base rate" where the "base rate" is calculated as the entire pay for the week divided by the entire hours for the week. Changes during "B" can effect both the entire pay for the week and the entire hours for the week. For example:

- Adding, editing or removing worked time:

A change to the number of hours in "Workweek 2," even in the "B" period, can result in a change in the "base rate" if:

- Any time in Workweek 2 is paid at a non-standard rate, or

- Any piecework pay has occurred during Workweek 2

- Other changes:

In addition, even if the number of hours in workweek 2 do not change, there are many changes in "B" that may invalidate the payroll run by changing the total amount earned in the week. For example:

- A pay rate change (raise)

- Making a manual override on any time to a rate different than the employee's rate (set pay rate or differential)

- Changing worked time to/from a job that paid at a rate different than the employee's rate (set pay rate or differential)

- Changing worked time to/from a shift that paid at a rate different than the employee's rate (set pay rate or differential)

- Changing worked time to/from a holiday that created a rate different than the employee's rate (set pay rate or differential)

- Adding or removing paid piecework, tips, commissions or non-discretionary bonuses at any point in Workweek 2.

- Changing the settings for piecework, tips, commissions or non-discretionary bonuses, job differentials, shift differentials or holiday differentials for any point in Workweek 2.

To avoid unexpected invalidations and/or inability to edit time outside the payroll date range:

- Always run payroll for dates that match with employee workweeks. For example, if employee workweeks are Sun 12:00AM to Sun 12:00AM, be sure to run payroll reports that start and stop on Sun at 12:00AM also.

- Always run payroll for dates in the past, such that no edits will be made in any workweeks overlapped by the report.

|

Information

Information Sales

Sales Support

Support