316-264-1600 Information Information Sales Sales Support Support |

|

Applies to versions: 1.3, 1.4, 1.5, 1.6Payroll Configuration: Defining Overtime Calculations and How Hours are Paid OutTimeIPS calculates overtime pay based on the Overtime Pay Requirements of the Fair Labor Standards Act (FLSA) the following three articles cover much of the following:

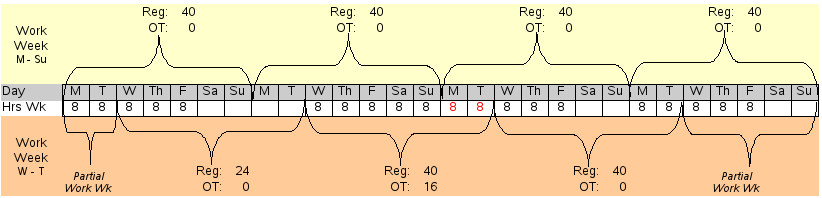

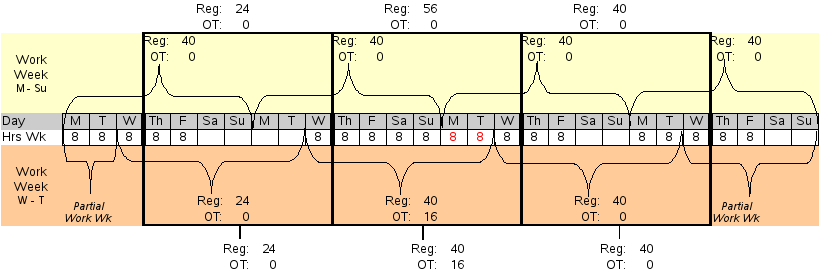

The Act applies on a workweek basis. An employee's workweek is a fixed and regularly recurring period of 168 hours -- seven consecutive 24-hour periods. It need not coincide with the calendar week, and may begin on any day and at any hour of the day. Different workweeks may be established for different employees or groups of employees. Averaging of hours over two or more weeks is not permitted. * U.S. Department of Labor, Employment Standards Administration Wage and Hour Division, http://www.dol.gov/esa/regs/compliance/whd/whdfs23.htm EXAMPLE: Company XYZ complies with the FLSA and pays employees overtime after they work 40 hours in a work week. To demonstrate how the work week setting can affect the way overtime is calculated, we have an employee who generally works Monday - Friday. However, she took Monday and Tuesday off and worked Saturday and Sunday instead. If the work week is defined as Monday through Sunday, the employee earns 40 hours a week, all in regular time. If the work week is defined as Thursday through Wednesday, the employee worked 56 hours in the second full work week so the hours in red are paid in overtime. The table below shows the same hours worked calculated into regular and overtime based on a Monday through Sunday work week on top and a Wednesday through Tuesday work week on bottom: Now, let's look at how the payroll period affects when those hours are paid. The Payroll Period defines what hours are paid in a given pay period. It does not affect how the hours are paid out as that is determined by the overtime calculations as described above. It simply indicates when the hours are paid. Let's look at the same employee's hours as above. We have applied a Thursday through Wednesday weekly Payroll period to the table. All of the hours will be paid, but some on a different payroll period. The employee worked a total of 3 days in the first full payroll period, 7 days in the second, and 5 days in the third. Using the Monday through Sunday work week, all of those hours are paid at regular time because she never worked more than 40 hours in a Monday through Sunday week. However, using the Wednesday through Tuesday work week, the employee earns 16 hours of overtime as she worked 56 hours in the second full Wednesday through Tuesday work week. No matter how you define your payroll period or your work week, employees will be paid for all hours worked. The overtime calculations and the payroll period in which those hours will be included are determined by the settings you define through TimeIPS. In TimeIPS versions prior to v1.5, the Work Week and overtime settings are defined in the Payroll Settings option. The Payroll Period is defined in the Payroll Types option. In TimeIPS versions 1.5+, Overtime Policies define how overtime is calculated for workweeks. These policies stand alone and do not, by themselves, determine how overtime is calculated for any one employee. Instead, you must link Overtime Policies to Workweek Groups. Workweek Groups allow administrators to manage sets of employees who follow the same workweek schedule and have their overtime calculation done in the same way. Net Pay CalculationsAs of TimeIPS v1.5, TimeIPS Overtime/Doubletime Net Pay Calculations are based on the following documentation taken from: http://www.dol.gov/dol/allcfr/ESA/Title_29/Part_548/29CFR548.2.htm(e) The basic rate so established is authorized by Sec. 548.3 or is authorized by the Administrator under Sec. 548.4 as being substantially equivalent to the average hourly earnings of the employee, exclusive of overtime premiums, in the particular work over a representative period of time; See Also: Payroll Settings (1.3, 1.4) Payroll Types (1.3, 1.4, 1.5) Workweek Groups (TimeIPS v1.5) (1.5, 1.6, 1.8, 1.9, 1.10, 1.11, 2.0, 2.1, 2.2, 2.3, 2.4) Overtime Policies (TimeIPS v1.5) (1.5) |